Part III. Spurious Claims and Grim Realities

No positive impact on tax revenues

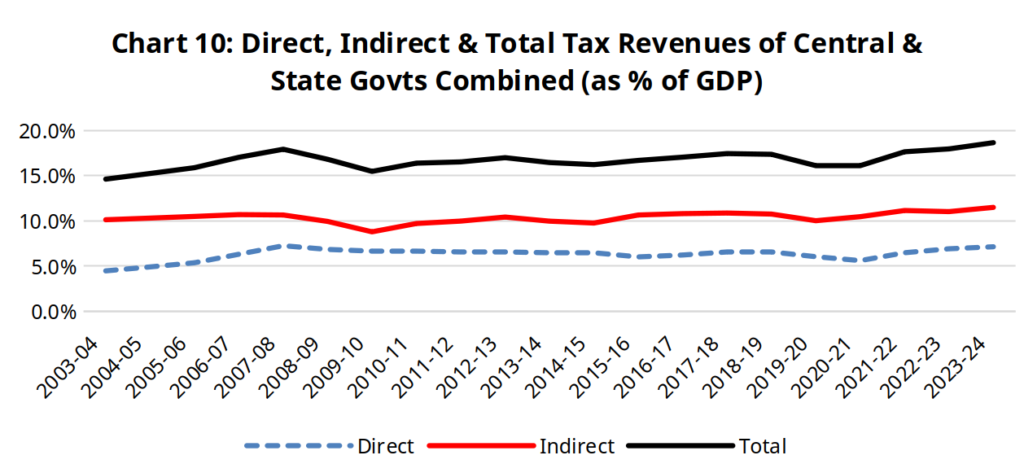

The proponents of digitalisation claim that digitalisation has strengthened the Government’s finances in two ways: it has improved tax revenues, and it has prevented leakages and corruptions in Government schemes. Nilekani says that “DPIs [digital public infrastructures] make the Government efficient”, pointing out that the Centre’s gross tax collection has risen 4.06 times from 2009-10 to 2021-22. However, this is in nominal, not real terms. At any rate, the appropriate way to measure tax revenues is as a percentage of national income, which grows each year.

Despite the vast exercise of imposing GST and spreading its net over an additional 8.8 million firms, and despite the much-advertised use of ‘big data analytics’ by the Income Tax Department to sniff out tax evaders, the tax/GDP ratio has stubbornly refused to rise for the last 15 years. The combined tax revenues of the Centre and the state governments, as a percentage of GDP, are 18.6 per cent, only slightly higher than the figure of 17.9 per cent in 2007-08.

Source: RBI Database.

Moreover, the share of direct taxes in total tax revenues of the Centre and states, at 38.3 per cent, is almost 5 percentage points below the figure for 2009-10, at 43.2 per cent. That is, taxation has become more regressive in recent years.

Source: RBI Database.

The stagnation of tax revenues does not sit well with the claims of rapid growth, since richer economies generally have higher tax/GDP ratios. If digitalisation has aided anything, it is the Government’s shift to a greater reliance on indirect taxes, at the expense of the majority of people.

Spurious claim of giant savings due to digitalisation

Under the heading “Reaping the Benefits”, and the subheading “Fiscal gains: expenditure efficiency and adequacy”, a recent IMF paper, Stacking up the Benefits: Lessons from India’s Digital Journey baldly asserts that “The DBT (Direct Benefit Transfer), in coordination with Aadhaar implementation, has helped to reduce leakages, curb corruption and provide a tool to effectively reach households to increase coverage.” However, when it comes to the details of this miracle, it becomes more guarded and evasive.

There is a reason for this caution: the extravagant claims made by the World Bank, the Government of India and government officials about the large savings on account of Aadhaar and DBT have been repeatedly refuted. These refutations have on occasion resulted in revisions or partial retractions. Yet the claim of giant savings remains, a ‘zombie statistic’, refusing to die even after having been repeatedly put to death.

Indeed, after the initial inflated claim of saving, the ‘savings’ keep mounting, annually updated on the Direct Benefit Transfer website of the Government of India (https://dbtbharat.gov.in/). In March 2021 the figure of “Estimated Benefits/ Gains from DBT and Other Governance Reforms” was Rs 2.21 lakh crore (lakh crore = trillion); in March 2022 Rs 2.85 lakh crore; and in March 2023 Rs 3.49 lakh crore – rising by about Rs 0.64 lakh crore/year.

Several commentators have performed a great service to the people by exposing these claims, and we refer readers to their writings. Among the problems they point to are the following:

1. No baseline surveys or studies were carried out to assess the scale of leakages/ghost beneficiaries in different schemes at the time of integrating Aadhaar with DBT. In the absence of such surveys, the estimates being made of the savings are merely fanciful. For example, one semi-official study used out-of-date estimates for one scheme, and extended the same (invalid) percentages to other schemes for which estimates were not available.

2. As a corollary of pt. 1, the Government simply assumes that all deletions of LPG connections, ration cards, NREGA job cards, and beneficiaries of other schemes are justified, and that there are no ‘errors of exclusion’. Hence it treats all such deletions as savings. However, there is ample evidence, including survey-based data, of sizeable exclusion errors. In such cases, the claimed ‘savings’ may in fact reflect harm done.

3. Many of the deletions were carried out before Aadhaar, using methods such as the lapsing of inactive users and computerised de-duplication. These methods are less likely to have harmed genuine beneficiaries, but they also would not have resulted in much saving: for example, in the case of inactive users, there would have been no drawals of benefits even before deletion. The numbers of such non-Aadhaar-related deletions may be large: For example, the overwhelming bulk of invalid LPG connections were removed by de-duplication procedures well before Aadhaar-linking. It is significant that the DBT website titles its table: “Estimated Benefits/ Gains from DBT and Other Governance Reforms” (emphasis added). There is no explanation of which other governance reforms this refers to, how much they account for, or why they have been clubbed with DBT. In the absence of a disaggregation, it is not possible to attribute these “benefits/gains” to the Aadhaar-DBT.

4. The methodology by which the Government has calculated ‘savings’ is simply not disclosed for the majority of heads under which it claims them. The DBT website provides merely a figure for the number of beneficiaries deleted. Even assuming these are valid deletions, there is no explanation of how the figure of savings is arrived at.

5. When the methodology is disclosed, it often does not stand up to scrutiny. For instance, one of the most widely publicised claims, of large savings on account of Aadhaar-linked DBT on liquefied petroleum gas (LPG) cylinders, has been authoritatively refuted. Among other critiques, an official report of the Comptroller and Auditor General found that the savings on account of the Aadhaar-based DBT had been exaggerated by a factor of 13. This is because more than 90 per cent of the reduction in subsidy took place as a result of global petroleum prices falling sharply, narrowing the gap between the import price and the consumer price.

6. There may well be sizeable leakages in specific schemes, but it is doubtful that the bulk of these are on account of ‘ghost’ (i.e., fake) beneficiaries. For example, the main method of diversion from the Public Distribution System is unlikely to be ‘identity fraud’ or ‘eligibility fraud’. Rather, it appears to be ‘quantity fraud’, i.e., i.e. the beneficiaries are given a smaller quantity than their entitlement. This fraud cannot be checked by Aadhaar, but only by direct investigation (and more fundamentally, by the consciousness and organisation of the people). Similarly, in the case of NREGA wages, it is only one type of fraud that can be checked with Aadhaar; the other types can continue unchecked.

7. Apart from sizeable errors of exclusion, there are what economists call ‘transaction costs’ on account of Aadhaar, even for those who do manage to obtain a benefit. For example, the number of visits a person has to make to the bank or ration store in order to obtain a benefit involves transport costs and loss of wages, apart from physical and mental strain, to the person on the days devoted to this exercise. Since Aadhaar verification requires that several “fragile technologies” (Aadhaar seeding, functioning point-of-sale machines, electricity supply/battery life, internet connectivity) all function, the chances of a transaction failure are considerable.

The class bias in all this is quite brazen. It is striking that none of the authorities who cite large savings – the Government of India, the World Bank, or the IMF – has cited a survey to estimate either exclusion errors or transaction costs. In any cost-benefit analysis, all costs need to be taken into account, and a justification needs to be provided for the value assigned to the costs (the same applies to the benefits). In the case of Aadhaar-linking of welfare payments, as Rajendran Narayanan points out elsewhere in this issue, exclusion errors have to be assigned greater weightage than inclusion errors, as the latter implies only a burden on the Government, whereas the former means a loss of rights, even in some cases the right to life. Let alone giving proper weight to exclusion errors, there is simply no account taken of them by the Government of India or the IMF.

Similar is the case for transaction costs. According to the IMF paper, digitalisation, including Aadhaar, has improved the “efficiency” of public expenditure. However, this “efficiency” is presented only from the side of the Government, not that of the recipient. For example, let us say that the average NREGA wage income per household is Rs 9,000/yr. Let us say that the loss on account of bus fare to the bank, loss of income on the days of bank visits, ‘commissions’ to Banking Correspondents, and loss of wages on account of the failure of the NMMS app amount to Rs 1,000 per household. This might then mean that the benefit people received was, say, Rs 7,000 crore less than what the Government spent, reducing to that extent the “efficiency” of public expenditure. However, transaction costs are entirely missing from the Government’s calculation. The questions of exclusion errors and transaction costs are dealt with in the article by Narayanan in the present issue of Aspects.

Widespread violation of rights

While the proponents of Aadhaar claim it acts “as an instrument of social inclusion”, this is not borne out by the facts. A Lokniti-CSDS survey during the 2019 national elections asked electors were asked whether they had ever been denied foodgrains due to non-possession/production of an Aadhaar ID or because their Aadhaar biometric details didn’t match, or on account of technical or server issues. The survey found that 28 per cent of ration card-holding households had experienced such a situation.

In both rural and urban areas, the Lokniti-CSDS found the poorest were worst affected: 39 per cent of households with a monthly income below Rs 2,000 said they were at some point denied PDS ration due to Aadhaar problems. In the Hindi belt, Bihar, Jharkhand, MP, Chhattisgarh, Rajasthan, UP and Uttarakhand, with relatively higher levels of poverty, 40 per cent of ration card-holding households reported a denial of ration due to Aadhaar issues – double the percentage in the rest of the country.

In the case of Bihar, Jharkhand, MP, Rajasthan and Chhattisgarh, the same question was posed again during CSDS-Lokniti surveys at the time of Assembly elections during 2019-21, allowing us to cross-check the results of the earlier survey. These larger-sample surveys found that the share of ration card-holding households reporting they were denied rations due to Aadhaar-related factors was 36 per cent in Rajasthan, 39 per cent in Chhattisgarh, over 40 per cent in MP and Jharkhand, and 56 per cent in Bihar. The problem was not limited to the PDS: similar percentages of the population were denied benefits of government schemes (they were eligible for) due to Aadhaar-related issues.

Awkward history of unfounded claims

The estimates of giant savings through Aadhaar-linked DBT have had to undergo embarrassing revisions.

In response to studies by the International Institute for Sustainable Development (IISD) questioning official estimates of savings of around $2 billion on LPG subsidies, Chief Economic Advisor Subramanian and a co-author clarified that “the saving was potential not actual and was conditional on prices and subsidy levels.” They suggested that their estimate would hold for a prospective fiscal year and under conditions of full rollout of the scheme. However, the IISD showed that, in 2015-16, the savings were of the order of $18 million, or less than 1 per cent of the projected savings.

In a particularly appalling case of statistical manufacture, the 2016 edition of the World Bank’s flagship publication, World Development Report, titled Digital Dividends, claimed that “This [LPG] is just one of many subsidy programs in India that are being converted to direct transfers using digital ID, potentially saving over US$11 billion per year in government expenditures through reduced leakage and efficiency gains.” However, Reetika Khera pointed out that the footnoted source of this figure was an estimate of the size of India’s entire cash transfer programme (including NREGA, pensions, etc); can “potential savings” exceed all cash transfers? The World Bank, in response, did not correct the sentence claiming $11 billion savings; instead, it replaced the footnote with a new, much longer, footnote, providing an entirely different justification for the $11 billion figure. But this evident afterthought too was riddled with patent absurdities. Despite a subsequent refutation by Khera and Jean Drèze, the World Bank made no further revision or correction. Indeed, the zombie statistic refused to be buried, instead returning to be cited by the Government in an affidavit in the Supreme Court of India.

It is this awkward history that the IMF’s Stacking Benefits paper seeks to deal with in the following passage:

The DBT undoubtedly led to significant savings but it is difficult to disentangle its effect from other developments. At the time of the introduction of the JAM trinity [Jan Dhan-Aadhaar-mobile] and adoption of the DBT for various schemes, broader macroeconomic developments and other policy developments that coincided are also key. For example, the adoption of the DBT for PAHAL coincided with lower international oil prices. Others have argued that, for PAHAL, the LPG subsidy regulation program – which started in 2013 – has been responsible for the identification and removal of invalid connections (Clarke, 2016) instead of the Aadhaar component of the DBT.

This show of noting the criticisms does not even attempt to answer them. The authors then fall back on the Government claim, which is not subjected to any critical examination:

The Government of India estimates that up to March 2021, the government saved about 1.1 percent of GDP due to the DBT and other governance reforms (Table 2). Most of the savings are attributed to the elimination of duplicate, non-existent and ineligible beneficiaries. For the PAHAL, the termination of the dual pricing mechanism which eliminated governance issues around the supply chain also led to savings. Despite the difficulty in estimating the sole impact of DBT on reducing leakages, it is inevitable that it played and will play a key role in preventing future issues in government schemes. (emphasis added)

The final sentence is a peculiar verbal manoeuvre to re-assert the claim of savings without answering the specific questions raised. The IMF proceeds to claim that Aadhaar-linked DBT “and related reforms” saved Rs 2.23 trillion, or 1.1 per cent of GDP, by March 2021. The IMF credits this figure to the DBT website and “Staff [i.e., IMF] calculations”. In turn, Indian government officials cite the authority of the World Bank and IMF reports.

The resort to such indefensible methodology by the World Bank and the IMF, and their refusal to address the issues pointed out by scholars, reflect their determination to promote digitalisation at all costs.

In the next section, we look at the stakes of imperialism in India’s digitalisation process.

Footnotes: