Opening to Foreign Investment in Government Bonds

Update and Preface (November 2022)

It is now over a year since we published the following article on our blog rupeindia.wordpress.com (November 6, 2021). Thereafter several developments have taken place. As we go to press a year later, the article is still relevant, but a brief preface from us is in order.

In the article we analysed the Government’s move to invite large-scale foreign investment in government bonds, and to get these bonds included in global bond indices. A global bond index tracks the prices of a particular selection of bonds in different markets worldwide. It guides the investment of global investor clients of these firms, with different bonds being given different weights in the index. Thus bonds that get included in these indices tend to receive large inflows of foreign investment. There are three major global indices of developing countries’ government bonds, managed by major financial firms in the US and UK.

We made the following points:

(1) Such inflows of foreign financial capital are useless to the Indian economy. Actually, India is already burdened with large surplus inflows of foreign capital, i.e., more than needed to pay for the current account deficit. The foreign exchange reserves are made up of these surplus inflows. All surplus inflows have to be re-invested abroad by the Indian authorities. But when these sums are invested abroad, they earn far lower rates of return than the returns that are paid out to foreign investors on their investments in India. Thus the cycle set in motion by surplus inflows causes a net drain. Getting further inflows would merely increase that drain.

(2) The proponents of opening up argue that such inflows reduce the direct cost of Government borrowing (increasing the quantum of funds flowing into Government bonds lowers the cost of funds). But this reduction in cost is not large. What is more, these inflows force certain additional fiscal costs on the Government, which more than outweigh any saving on the cost of borrowing.

(3) These inflows can turn into outflows at a moment’s notice, on account of developments in the global economy beyond the control of India. Indeed, such investors are termed ‘bond tourists’. India has experienced five such ‘sudden stop’ episodes in the last 15 years. In the given framework of our economy, sudden outflows would cause the rupee’s value to fall, trigger increases in interest rates, cause Government finances to deteriorate, and destabilise our country’s economy.

(4) Moreover, in order to get such inflows, the Government would have to fulfil certain preconditions. A consistent demand of foreign investors in government bonds is for complete freedom of capital flows in and out of the country (what is called ‘capital account convertibility’). Such ‘freedom’ would greatly increase the danger of a severe crisis. In October 2021 the RBI indicated that India was moving towards fulfilling this demand. Only the very top section of India’s elite, which is completely intertwined with international finance, benefits from such a regime.

(5) Even if a crisis (in the form of sudden outflows) were not to take place, the mere fear of a withdrawal by foreign investors would cause the Government to keep down its spending, expedite privatisations to beef up its revenues, provide corporate tax cuts, and adopt other policies favoured by foreign investors. We have already seen such curbs on Government spending over the last two years, during which the Government has been preparing for inviting foreign investment in its bonds. This policy of cuts in total public expenditure on the non-corporate sector has resulted in a grave depression for the majority of the Indian people.

Despite these dangers, the Government appeared hell-bent on its plan till January 2022. A last step was to be taken by the Government to seal the deal: Global investors wanted the Indian government to list its bonds on international platforms such as Euroclear, which settle securities transactions (similar to the way stock exchanges settle transactions in shares domestically). Euroclear pushed the Government even to exempt such transactions by foreign investors from Indian capital gains taxes.

It was anticipated that the Budget 2022-23 would announce such an exemption. Foreign investors were eagerly anticipating the opening-up, so much so that the US bank Citigroup Inc advised its clients to buy Indian debt in anticipation of the Budget. Foreign investors quickly reached the limit of the bonds available under the scheme, and in response the Indian government raised the ceiling further.

Then, quite suddenly, the Government baulked at going through with the measure. The Budget failed to announce any tax exemption for foreigners trading in Indian government bonds, leading to sharp criticism by foreign investors. Citigroup immediately advised its clients to sell Indian debt.

What was involved was not merely a question of a tax exemption: the Government no longer was certain that large-scale foreign investment in government bonds was desirable. When asked about the matter, the RBI Governor did an about-turn in February 2022, portraying foreign inflows into government bonds as double-edged, and potentially destabilising: “it works both ways, to have a greater flow of resources into the country, but when the index becomes adverse then… [there] could be sudden outflows.”

In other words, two years after announcing the plan, the Government and the RBI discovered the obvious dangers in tying Government borrowing to foreign inflows. For some time it appeared that the Government had abandoned the plan to attract such investments.

Then, in August 2022, the tide appeared to turn again. It was reported that the Government was once again in discussion with JP Morgan and Bloomberg, two major firms that provide global bond indices. Foreign investors apparently set aside their earlier demands for capital gains tax exemption and for settlement abroad. On August 29, Finance Minister Nirmala Sitharaman said that the question would “come to its logical conclusion” soon. The financial firm Morgan Stanley said that it saw a “good chance” of JP Morgan including Indian government bonds in its index very soon, and it recommended that investors bet on a rise in the price of the Indian government 10-year bond. Morgan Stanley predicted that India will receive a 10 per cent weight in the index, and receive $30 billion in inflows into government bonds during the next fiscal year. However, the outstanding issues were not concluded in September, and the final outcome remains uncertain.

Whatever the outcome, most points we make in the article regarding foreign capital inflows into Government bonds also apply to all other inflows of foreign financial capital. Hence the article below continues to be relevant (although some figures are out of date). Indeed, as mentioned above, Government authorities themselves, including the RBI Governor, expressed their apprehensions about such inflows earlier this year. Nevertheless, the Government seems intent on opening up to international bond tourists, for reasons mentioned in the following article.

— Editor.

I. Drain

It is now the 75th year since the end of British rule in India. The upcoming anniversary promises a rich vein to be mined for official publicity. The Information and Broadcasting Ministry has directed the print, electronic and digital media to display the newly minted logo of “Azadi ka Amrit Mahotsav” “so that citizens are made aware of India’s rich history and commitment to a bright future.” As the drumbeat of official Amrit celebrations gets steadily louder, each Central ministry is doing its bit; every public sector unit is scurrying to complete its quota of patriotic activities before it itself gets privatised. All this, no doubt, will rise to a climax on August 15, 2022 in the form of a grand sound-and-light spectacle celebrating an independent, atmanirbhar, and fully vaccinated India.

Meanwhile, the Indian authorities are putting the finishing touches on a financial regime that will perpetuate an unprecedented level of control of India’s economic policy by foreign investors, overruling any lingering considerations of the needs and demands of the Indian people. It is important to grasp that this move has no other rationale whatsoever, even by the most conventional textbook economics. The simple mechanism through which this regime is to be instituted is large-scale foreign investment in government bonds. Below we outline how this works. (We have written about this once before, but it is worth looking at it again.)

Foreign investment in government bonds: part of a perverse cycle

Like most governments, the Indian government has long borrowed money by issuing bonds to investors in its capital markets, including to domestic banks, insurance companies, and others. Till recently, however, Indian governments have either barred foreign investors in such bonds or restricted their total investment, conscious that large movements by such investors into and out of these bonds can destabilise Government finances, the value of the rupee, and the economy as a whole. But for the last few years, the Indian government has been on a single-minded drive to attract inflows of foreign investment into government bonds, shaping the entire economy to this end.

Internationally, a number of countries – including some developing countries – do allow foreign investors to invest in their government bonds. For investors from the developed world, the attraction of these bonds is that they are relatively stable, since they are backed by governments, not private companies; and the interest rates are much higher than could be earned in the developed world, particularly in the present phase of rock-bottom interest rates there. International investors spread their risk further by investing, not in just one or two bonds, but in a basket of such bonds of different countries. These baskets, or indexes, are constructed by certain giant financial firms in the developed world, who certify that the bonds are stable, plentiful, and easily traded; and that the country’s economic policies make it creditworthy. The index-providing firms confer specific weights in the total index to bonds of different countries. Once a country’s government bonds are added to such an index, a certain amount of foreign investment would tend to automatically flow into its bonds.

The presumption behind this, of course, is that the country needs that foreign investment. And, on the face of it, it seems obvious that a country with scarce capital and a budget deficit would benefit from an ample flow of foreign savings into it. But leaving aside any more fundamental questions regarding the benefits and costs of foreign investment, the question must first be asked: When foreign investors buy Indian government bonds at present, are foreign savings indeed entering the Indian economy as such? Do they add to economic activity in India? The reality is, NO. In a perverse cycle, what happens is that when foreign investment flows into such government bonds, the Indian government re-invests it abroad at a much lower interest rate.

Drained by the circuit of capital flows

To see why this is so, it is important to understand that a country can only avail of foreign savings to the same extent it runs a Current Account Deficit, or CAD. Broadly, a CAD occurs when a country’s imports are larger than its exports. If a country imports more than it exports, it needs to pay for that deficit from somewhere. So it avails of foreign savings in order to pay for its deficit. These foreign savings enter in the form of capital inflows – mainly loans and investments (grants are negligible). But what if the capital inflows are more than the CAD?

Consider the case of a person who has spent Rs 1000 more than she earns. She can pay the difference by borrowing money from someone else’s savings. However, suppose she is forced to borrow Rs 2,000, i.e., double the amount she needs, of what use to her is the extra Rs 1000? She would have to put it away, say, in a bank deposit. In the unlikely event that the bank pays her higher interest than she is paying out, she would of course gain from the whole transaction; but if the bank pays her lower interest than she is paying out, she would lose.

The case of a country is similar: Any inflows of foreign capital in excess of the country’s Current Account Deficit have to be parked in investments abroad. Consider two contrasting cases:

(1) If the borrowing country’s own interest rates are low, and the returns it gets on its foreign investments are relatively high, it can keep recycling its inflows and make gains on that circuit of capital. Such is the case of the United States. That it can do so reflects the fact that the US is still the world’s leading imperialist power, and its dollar is therefore still a safe haven in which countries and private investors around the world park their capital.

(2) However, when a borrowing country’s interest rates are high, but the returns it gets on its foreign investments relatively low, it is drained by that circuit of capital. That is the case of India – and it is a reflection of India’s actual subordinate status in the global economic order.

The existing burden of excess inflows

Existing inflows of foreign capital into India come in different forms – when foreign firms invest directly in firms here (foreign direct investment, or FDI), when foreign investors buy shares in India’s share markets (foreign portfolio investment, or FPI), and foreign loans made to Indian borrowers. These inflows are already much larger than India’s current account deficit, i.e. they are more than India needs to pay for the gap between its imports and its exports.

The RBI keeps buying up these excess inflows of foreign exchange and adding them to the country’s foreign exchange reserves, as a result of which India’s forex reserves keep reaching new peaks – $637.5 billion on October 1, 2021, enough to pay for 18 months of imports. The foreign exchange reserves shot up more than $87 billion in 2020-21. It was a year in which the lockdown and the depression of demand caused imports to fall steeply. India actually ran a current account surplus of $23.9 billion that year; it did not require even a dollar of the capital inflows.

The RBI holds these reserves by investing in stable assets abroad – the biggest of which are US government borrowings, called ‘Treasuries’. At end-August 2021, $217 billion, or more than one-third of India’s reserves, were in US Treasuries, and India was the world’s 13th-largest holder of Treasuries.

Why then is the Indian government intent on soliciting yet more foreign inflows?

The principal argument made by advocates of opening up to foreign investment in government bonds is that it will reduce the interest rate on Government debt, and thereby save the Government money. On closer examination, this turns out to be untrue. Even if the interest rate were to decline due to the foreign inflows, the Government is forced to incur certain other fiscal costs on these inflows, and these other costs are multiples of any projected saving on interest rates. (See Appendix I for details.)

National drain

More importantly, there is a national drain on account of this flow of funds in and out of the country. The interest the RBI earns on its foreign investments is minuscule: just 2.1 per cent in 2020-21, far below the rate it pays on its borrowings. By contrast, the return on a 10-year Indian government bond is 6.32 per cent at the time of this writing (October 28, 2021). And the return on other foreign investments in India is much higher.

In an important study of 2008, Nirmal Chandra calculated the annual drain from India as at end-2007, and found it to be comparable to the annual drain under British rule. He provided two alternative estimates, taking returns on FII investments to be between 15 per cent and 25 per cent (the Government does not provide data on this critical question). At the time, the annual returns on the foreign exchange reserves were 4.6 per cent, and the reserves were at $275.6 billion, so the returns were $12.7 billion. On the other hand, the outflow came to $42.9-$68.5 billion. The net outflow, at $30.2 billion-$55.8 billion, was thus 2.6 to 4.7 per cent of GDP.

Citing A.K. Bagchi’s estimate of the annual drain/loot under colonial rule (4.0 per cent of GDP for the period 1911-16), Chandra observed that this lies within the range of estimates for the present-day drain. He marked that “while the drain during the autocratic British raj could be estimated from published data, our democratic government after 1991 skilfully camouflaged profit-taking by the FIIs.”

Interestingly, while the size of the foreign exchange reserves today is more than double the figure at the time Chandra made his calculation, the rate of returns India earns on those reserves is less than half the rate in 2007 (dropping from 4.6 per cent to 2.1 per cent). Hence the absolute sum earned on them would be about the same today as estimated by Chandra for 2007. Whereas the rate of returns that foreigners earn on their investments and loans is unlikely to have fallen. Hence the net outflow should be larger than Chandra estimated at that time.

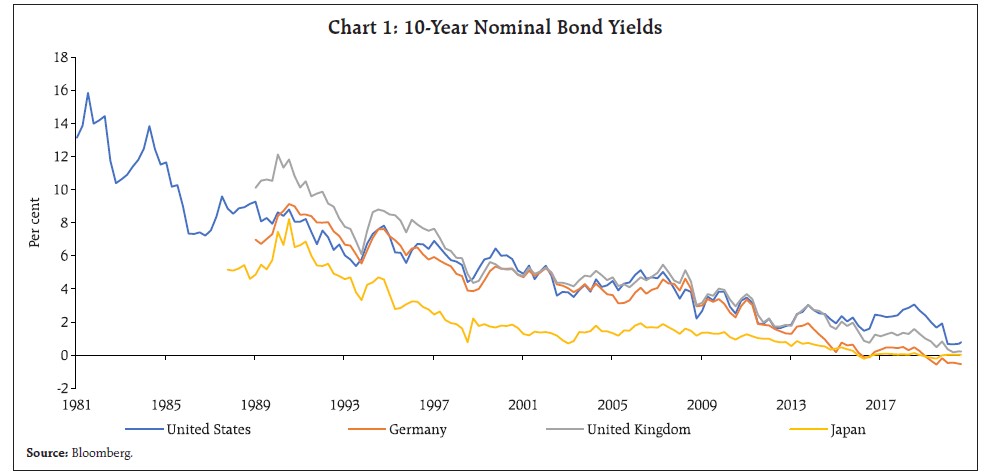

In the October 2021 RBI Bulletin, the RBI points out its predicament: the interest rates on government bonds of developed countries are desperately low, near-zero or even negative (see Chart 1 below); “This low yield environment has made it an arduous task for the Reserve Managers to generate reasonable returns on their foreign assets.” It suggests various possible ways of increasing returns by investing in riskier foreign assets, including in share markets abroad. There are also reports that India’s Reserve Bank is contemplating using outside experts (presumably foreign firms) to manage the reserves in order to get better returns.

Source: RBI Bulletin, October 2021

Now that the RBI has opened up government bonds to foreign investors on a large scale, the foreign exchange reserves, and the net outflow, would rise further. Moreover, not all foreign investors would confine themselves to holding these bonds and earning interest on them. These bonds are traded every day in the bond market, and their prices rise and fall. Foreign investors will actively trade these bonds, like shares on the stock exchange, and earn profits on buying and selling them. It is for this reason that index-providing firms are insisting that the Indian government do away with the capital gains tax on trading in government bonds. These trading profits are likely to be much higher than the interest rate on the bonds, thereby increasing the drain.

The proposal to get Indian government bonds listed in global bond indexes has been under discussion since at least 2013, but it was considered too risky. In 2016, the Modi government began increasing the process of raising the ceilings, and in 2018, it began negotiations to get India included in global indexes. Before the latest liberalisation (March 2020), there was a 6 per cent ceiling on foreign investment in Indian government bonds, but in fact foreign investment remained far below the ceiling, at only 2-3 per cent. Now, with over $200 billion in Indian government bonds opened up for foreign investment without limit, the share of foreign investors in India’s government debt is set to rise. What will be the consequences?

II. External Control

India’s index inclusion aspirations dictated its miserly fiscal response to Covid-19

In a sense, we have already been experiencing the consequences, since the Government has been grooming the economy for this for over two traumatic years.

On March 30, 2020, while India was locked down and the attention of the nation was focussed on Covid-19, the RBI issued a notification opening certain specified categories of government bonds fully for foreign investors. It clarified that more and more such bonds will be added to the ‘Fully Accessible Route’; at present about $200 billion of bonds are available. For their part, the leading index providers – firms such as FTSE Russell, JP Morgan, and Bloomberg Barclays – have announced that they are in discussions with the Indian government and plan to phase India’s inclusion over a length of time.

The Government’s determination to stay on track for bond index inclusion helps explain why it was so tight-fisted induring its draconian lockdown of 2020, and has refused to increase spending through 2021 as well. (In July 2021, the cumulative Central government expenditure as a percentage of the budgeted expenditure for the year was just 23.8 per cent, compared to a 10-year average of 33.8 per cent. Central expenditure for the first quarter of 2021-22 was nearly 5 per cent lower, in real terms, than the previous year.) That is, the Government plans to stimulate growth solely by providing the private corporate sector handsome profit-making opportunities, rather than directly stimulate demand through government spending.

The Government’s refusal to spend is intensifying the current depression in India, but this refusal seems to have won the approval of international finance. For example, a January 2021 report by one of the world’s largest asset management firms, State Street Global Advisors (India Sovereign Bonds: Index Inclusion on the Horizon), makes the case for investing in Indian government bonds.

Firstly, the report points out that India’s currency has been stable. But this ‘stability’ has been the result of its attracting large flows of foreign investment, and the RBI dutifully shoveling these flows into the foreign exchange reserves. In other words, the stability of the rupee depends on India continuing to be a well-behaved member of the club of those developing countries that adhere to policies approved of by foreign investors.

Secondly, the State Street report points out that the returns on Indian government bonds are attractive in comparison with those of other countries with a similar credit rating. Thirdly, it notes approvingly that India has kept down Government spending during the Covid-19 crisis much more than other developing countries:

India demonstrated a restrained fiscal response to the COVID-19 pandemic… JP Morgan estimates the fiscal impact [of economic stimulus measures] to be ~1.5% of GDP in Fiscal Year 2020–21, half the level undertaken by emerging markets, on average. (emphasis added)

Instead of boosting demand through Government spending, the report points out, India has relied solely on neoliberal, pro-corporate restructuring as a growth strategy:

The government had been implementing several structural reforms before the pandemic, with corporate tax rate cuts, a bankruptcy law to facilitate resolution of non-performing assets, and steps that improved the ease of doing business. Progress in reforms continued after the outbreak as well, with the government expecting this strategy to help stoke a robust medium-term recovery. There have been announcements in production-linked incentives for manufacturing, relaxation of manufacturing sector labour laws, opening up state monopolies in coal mining, railway services, and power distribution to the private sector, introducing incentives to encourage formal employment and removing barriers to agricultural trade by allowing farmers to enter into contracts with private companies. (emphasis added)

It is important to realise that, once foreign investors have a significant share of Indian government bonds, the above policies cannot be reversed or even seriously modified without triggering a negative ‘vote’ from the foreign bondholders.

Fear of foreign investors will act as “an additional source of fiscal discipline”

This is quite candidly stated by Jehangir Aziz, the global head of J.P. Morgan Emerging Markets Economics, in an interview with Bloomberg Quint.

I think it also does something that I think that, for lack of a better word, we haven’t managed to do, which is to provide an additional source of fiscal discipline that we hadn’t had…. We have seen how other countries in the emerging market world – just neighbouring country, Indonesia – Indonesia has managed to keep its fiscal deficit below that 3 per cent level for almost like 10-12 years. And part of the reason is that a significant amount of discipline has been imparted on the Indonesian government. And to keep fiscal deficit at that level because of the fear that there is now a bunch of people who can actually keep insurance and who can actually react to bad fiscal policy, right? (emphasis added)

A triple blow would likely result if foreign investors hammer down the prices of government bonds, as a reaction to fiscal policy they do not approve of:

(1) The effective cost of government borrowing would rise. Then, given the policy frame of the Government, it would cut on other expenditures in order to keep within its fiscal targets.

(2) The sudden exit of foreign funds would make the rupee’s value drop precipitously, making imports, including crude oil, more expensive and causing inflation to rise across the board.

(3) The flight of foreign investors from government bonds might trigger uncertainty about other bonds as well, and lead to a rise in other interest rates.

All these are not hypothetical, but have actually been observed in many countries when foreign investors exit government bonds.

III. Which Interests Are Behind This

Capital account convertibility

Beyond the explicit conditions placed by the index-providing firms (such as removal of restrictions, scrapping of capital gains tax on trading in government bonds, use of a depository abroad for settling bond transactions), there is a further unwritten demand: removal of all controls on capital movements in and out of India, what is called “capital account convertibility” (CAC). The RBI’s Tarapore Committee defined CAC succinctly as the “freedom to convert local financial assets into foreign financial assets and vice versa”. In a word, foreigners can buy any Indian asset without restriction, and Indians can sell off Indian assets and transfer the money abroad. Foreign investors have long demanded this freedom, as have the top section of the Indian elite.

A recent speech (of October 14, 2021) by a deputy governor of the RBI says that, with the opening up of government bonds to foreign investors, “India is on the cusp of some fundamental shifts… The rate of change in capital convertibility will only increase… Market participants, particularly banks, will have to prepare themselves to manage the business process changes and the global risks associated with capital convertibility.”

There are various degrees of CAC, and India is already at a fairly advanced stage of it. Both FDI and FPI investors are permitted to invest in almost all sectors (with a handful of restrictions in specific sectors), and are equally permitted to sell these assets and repatriate the proceeds. External commercial borrowing is also permitted with few restrictions. Indian citizens, including minors, can send out $250,000 a year under the Liberalised Remittance Scheme; a family of four can thus send out $1 million a year. And now the Government has opened government bonds to foreign investment, eventually without any restriction.

Virtually the only remaining step is to allow Indian citizens to sell their assets and transfer the proceeds out without restriction. Of course, making such transfers would really be practicable only for the top few per cent of the households in India. These households are also the owners of most assets: while Credit Suisse estimates that the top 1 per cent in India own 40.5 per cent of the total wealth, their share of assets which can be sold off (unlike residential homes and land), is much, much higher. Capital account convertibility (CAC) opens up scope for massive capital flight. It would greatly amplify the impact of any sudden outflow of foreign investment: as dollars flow out and the rupee’s exchange rate falls, the Indian elite too might transfer their assets out at a faster rate. A large number of Third World countries, such as Mexico (1995), Indonesia, Thailand, South Korea (1997-8), and Argentina (2001), have experienced devastating episodes of capital flight.

Given these grave implications, why is the Indian government opening up government bonds for foreign investors and the Indian ruling classes welcoming it? There are two aspects to this: the push from international capital; and the Indian ruling classes’ own calculations.

The push factor: international capital wants to enter Indian government bonds

In the media, the topic is framed as India’s attempt to get its government bonds in global indexes, with index provider firms assessing whether India has fulfilled the requirements for inclusion. However, this ignores the fact that international capital wants the opening up of India’s government bonds market.

Essentially, the push from international capital for India to open up its government bonds is for two reasons:

(1) at present, there is a sea of money in the developed countries seeking higher returns elsewhere; and

(2) many underdeveloped countries had undergone a massive expansion of debt even before Covid-19, due to an earlier such flood of foreign investment inflows from the developed world. Now there is an impending debt crisis in those countries. Hence the developed countries’ financial investors must find new targets for investment. (We have discussed this below in Appendix II: Stark Divergence.) This is where India comes in: It is the last big hunting-ground for international investors in government bonds.

The Indian ruling classes’ own calculations and its interests

That explains why foreign investors want in. But, given that there are no benefits, only costs, for India from such investment, why are the Indian rulers striving for this?

Firstly, as is well known, India’s economy and political life have come under an unprecedented level of private corporate control; and the summit of India’s private corporate sector is now more closely integrated with international capital than ever. This takes the form of foreign loans, foreign portfolio investment and foreign direct investment. Surajit Mazumdar notes:

The spectacular expansion of Indian big business during the last two decades has heavily depended on, rather than being despite, international integration. Foreign capital flows and access to external capital markets has played an important role in enabling both domestic and overseas expansion of Indian capital. One expression of that has been the increased recourse to foreign financing by Indian firms. Capital inflows have also contributed indirectly; given India’s current account situation [i.e., given that India consistently runs trade deficits – Aspects], they were essential requirements for the easing of norms for Indian investment abroad, and they have been important movers of the Indian stock market creating conditions whereby Indian firms could raise cheap capital. Access to technology and imports of capital goods and intermediate products where they are cheaper has contributed to the competitiveness of Indian firms and enabled them to find some niches in which they could grow, often in a collaborative arrangement with foreign capital.

By June 2021, India’s non-Government external debt – essentially the foreign borrowings of the private corporate sector – amounted to $464 billion, or 81 per cent of India’s external debt, and 16.4 per cent of India’s GDP. The large flows of foreign capital into India, and the surging foreign exchange reserves, also make the Indian corporate sector less ‘risky’ in the eyes of foreign lenders, and allow the corporate sector to borrow more cheaply abroad. Indeed, their foreign loans have to an extent reduced their dependence on credit from Indian banks.

It is noteworthy that the large foreign exchange reserves have reassured the Government that they can relax restrictions on large outward foreign direct investment (OFDI) by Indian firms, which is a step toward capital account convertibility; at present automatic approval is given for outward investments up to 400 per cent of the investing firm’s net worth. Cumulative OFDI during 2000-01 to 2018-19 came to $179.5 billion. A substantial portion of this may be ‘round-tripped’ capital, i.e., Indian firms sending out capital as outward FDI, and bringing it back in under another name (benami) as inward FDI. As one study points out,

It is clear that Indian OFDI flows are dominated by economies considered to have an advantageous fiscal regime such as Mauritius, Singapore, the British Virgin Islands, the Netherlands, Switzerland and Cyprus. In addition to possessing favourable treaties covering bilateral investment, double-taxation avoidance or comprehensive economic partnerships with India, many of these countries also offer low tax rates and access to international financial markets in order to attract Indian firms. As such economies are less likely to be the ultimate destination of Indian OFDI flows, one part of such flows may be redirected to other countries while another part could be round-tripping, i.e. coming back to India as FDI inflows.

The returns on such outward FDI are likely to be lower than the returns on the inward FDI (the foreign firms to which such investment goes are shell firms, whereas the Indian firms receiving such investment are real firms). Hence such ‘round-tripping’ flows also act as a continuing drain.

Apart from such round-tripped capital, the top Indian firms are major recipients of foreign investment and loans. Mukesh Ambani has sold 33 per cent of Reliance Jio to US firms, and has given them places on the board; and foreign portfolio investors hold more than 25 per cent of the parent firm Reliance Industries. Foreign inflows have helped propel Ambani to the position of the richest man in Asia and 10th richest in the world. The Tata group’s giant foreign acquisitions were funded in large measure by foreign borrowings. The Adani group is among the most indebted corporate groups in India, with outstanding loans of $30 billion, but is still able to tap foreign markets for capital without difficulty. It has sold large stakes in its firms to foreign giants such as Total, and “international groups are queueing up to partner with the mogul.”

The extent of integration is exemplified by the first-generation Indian tycoon Anil Agarwal, a metal scrap dealer-turned-industrialist who profited greatly off India’s early privatisations. In order to get access to international capital markets in the 2000s, Agarwal incorporated the firm Vedanta Resources in London. Eventually the group became a multinational conglomerate headquartered in London, where Agarwal himself resides.

Given the above, India’s corporate tycoons welcome measures for further integration of the Indian economy with international capital, such as opening the government bond market and moving towards capital account convertibility. They look forward to a situation in which they are completely free (they already are partly able) to move their capital in and out of the country, in much the way they themselves move in and out of the country.

But even as Ambani, Tata, Adani and Agarwal have all attempted to ‘internationalise’ their groups and have purchased assets abroad, their stakes remain overwhelmingly in India. Their efforts to expand internationally have so far seen at best minor successes, and also some spectacular failures. (Interestingly, Tata’s largest foreign acquisition has proved a disaster; the group has survived and been able to service foreign loans taken for the acquisition of Corus on the strength of its domestic operations. And while Vedanta is headquartered in London, most of its assets are in India.)

It is not Indian big business houses’ technological dynamism or industrial entrepreneurship that secure their dominant position in India. Rather it is their India-specific capabilities – viz., their ability to ‘manage’ the Indian State regulatory machinery and political forces, their ability to capture Indian markets through anti-competitive methods, and the influence they wield in Indian society. Those ‘native’ mercantile skills in turn ensure their access to foreign capital for their expansion. Correspondingly, foreign financial capital turns to these ‘Indian’ firms for access to India. As such, the relationship of India’s top corporate firms to the Indian economy is subsumed in the relationship of imperialism with India.

Thus the interests of the top corporate houses have in a crucial sense seceded from India itself, even as their stakes predominantly lie here.

But there is a wider layer of India’s elite (sometimes mistakenly labeled ‘middle class’) that provides support for the big bourgeoisie’s agenda. This layer has strong links to the developed countries. Many plan to shift there (India reportedly experienced the highest percentage of out-migration of ‘high net worth individuals’ of any country between 2014 and 2017 – and perhaps thereafter too), and many have relatives studying or residing there.

Note that the Indian media and the bulk of the intellectuals (including academia) provide intellectual justifications for these policies. Mark the near-complete silence on the issue of the opening-up of government bonds to foreign investors! Barring a solitary article by two well-known critics of the Government’s policies, we are unable to find a single critical comment in the media regarding this decision. When Jehangir Aziz of J.P. Morgan told his interviewer that the benefit of opening up Indian government bonds was that foreign investors could “discipline” the Indian government automatically by their market movements, and determine the Indian government’s spending policies, his remark did not earn a reprimand or castigation; rather, the interviewer nodded sympathetically.

It should also be kept in mind that, even if the Indian rulers scrupulously follow the code of conduct laid down by international capital, there is a possibility of crisis – for example, if interest rates rise in the developed world; if there is a crisis in the developed world (as in 2008); or if a crisis in other developing countries leads foreign investors to move out of all such countries. In 2013, as the US Fed began ‘tapering’ its Quantitative Expansion, funds began to flow out of India and many other developing countries, and moving to the US. The resulting panic was blamed on the developing countries, not the US Fed’s massive expansion-contraction cycles. Thus in 2014 the US investment bank Morgan Stanley damningly labeled India and four other developing countries the ‘Fragile Five’. All this took place before significant foreign investment in Indian government bonds; imagine a similar episode after foreign investors own substantial shares of Indian government debt.

On the other hand, even if no crisis takes place, the fear of such a crisis will always remain as a disciplining rod. This is particularly so since India’s foreign exchange reserves are not built out of trade surpluses, but out of foreign loans and other liabilities to foreigners, and much of these may exit at short notice.

What was once done by a colonial force is now to a large extent carried out with the help of economic, social, political and cultural structures that have been developed over time to serve, not Indian interests, but imperialist ones. To fully grasp this phenomenon, we would need to bring in a historical approach.

At the same time, the vast majority of the Indian people have neither such ties, nor free mobility options open to them, as the elite. For them, the further integration of India with the global economy portends a grim future, marked by a depression of demand and instability. When the economy is drained, it is the surplus created by their labour that gets drained. When the economy is destabilised by foreign capital flows, it is their livelihoods that get destroyed. When the economy is ‘restructured’, it is their labour that gets devalued. It is they who will have to wage a struggle for real independence, a travesty of which is being celebrated this year with pomp and wind.

[END]

———————————————————————————————-

Endnote:

Appendix I: Bogus Argument of the Benefits of Foreign Investment in Government Bonds

According to a report by the US firm Morgan Stanley, the inclusion of Indian government bonds in global bond indexes would attract a larger pool of funds seeking such bonds. As a result, the effective interest rate on such bonds (called the ‘yield’) would decline, and thereby the Government would be able to borrow more cheaply. Morgan Stanley estimates that effective interest rates on Indian government borrowings could reduce by 0.5 percentage points.

However, even this limited gain, if it materialises, would be illusory. For this it is important to understand the chain of developments set in motion when foreign capital flows inward in excess of the current account deficit.

Keep in mind that there are already large excess inflows of foreign capital, i.e., more than necessary to pay for the Current Account Deficit. As more capital flows in, and the supply of foreign exchange becomes more plentiful, the rupee’s exchange rate rises. When the rupee’s exchange rate rises sharply, two things happen: India’s exports become more expensive for foreigners to buy, and imports become cheaper for Indians to buy. As a result, India’s exports fall, hurting Indian producers of exports, and imports rise, displacing Indian producers catering to the home market. Hence, other things being equal, allowing the rupee’s exchange rate to rise sharply would bring about a depression of productive activity in India.

In order to prevent such a depression, the RBI buys up excess inflows of foreign capital from the foreign exchange market, and pays out rupees in exchange. However, this leads to a large increase in the total rupee supply in the country, much beyond the level targeted by the RBI. Therefore the RBI performs various operations to mop up (‘sterilise’) the excess money supply, by borrowing from the market; for example, banks lend money to the RBI through what is called ‘reverse repo’. The cost of such ‘sterilisation’ is large. According to former RBI official R.K. Pattnaik, “If we take into account only the fixed overnight reverse repo [when the RBI borrows money from the banks]… the fiscal cost thus works out to 1.25 per cent…. But the fiscal cost works out to be much higher if the OMO purchase/sale of securities is considered. Thus, the fiscal cost is a burden when we build up forex reserves.”

Now Morgan Stanley projects that an additional $250 billion would flow in over the coming decade solely on account of government bonds. All of that would have to be purchased by the RBI, and it would have to sterilise these flows. The sterilisation cost alone would likely be much greater than the projected saving in interest costs. So even in terms of budgetary costs alone, there is no rationale to soliciting more inflows in the form of foreign investment in government bonds.

Moreover, if the entry of foreign investors in government bonds results in the effective interest rate declining, what would happen if, for any reason, they decide to depart in large numbers? The reverse would take place, namely, interest rates would rise, and do so more precipitously, since a sharp fall in bond prices might trigger a panic. This possibility is not hypothetical; it has happened time and again with country after country.

Appendix II:

Stark Divergence – Growth in the North, Regression in the South

Below we discuss the background in which international capital is pressing India to open up its government bond market fully to foreign investors. It is a situation of impending crisis of developing country debt.

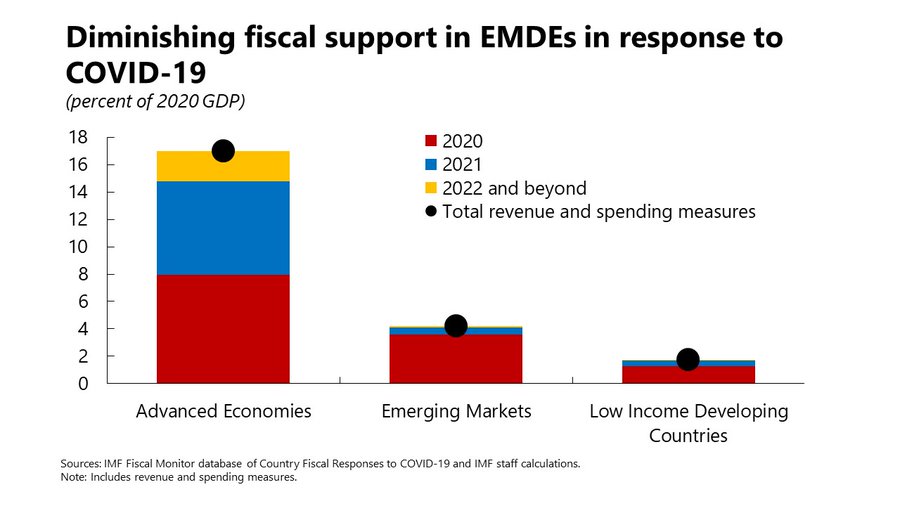

There is a stark divergence in the response of the developed countries and the underdeveloped countries to the phenomenon of Covid-19. When the crisis struck, developed country governments were able to massively expand their spending and their central banks similarly expanded money supply (by buying up assets on the financial markets and keeping interest rates at rock-bottom lows). Meanwhile, the underdeveloped countries, fearful of being downgraded by international credit rating agencies, increased their spending by meagre amounts.

The US government spending response included the CARES Act in 2020 ($2.3 trillion) and the American Rescue Act in 2021 ($1.9 trillion), and other sizeable measures, totalling in all over 25 per cent of US GDP – over and above its regular budgetary expenditure. This is a larger fiscal programme than ever mounted by the US in peacetime. (By contrast, as we mentioned earlier, India’s package of additional expenditure for Covid-19 was about 1.5 per cent of its GDP.)

At the same time, the US central bank (the Federal Reserve, or the Fed), lowered interest rates by 1.5 percentage points, to the range of 0-0.25 per cent. Further, the Fed revived the “Quantitative Easing” measures it took in response to the Great Financial Crisis (GFC) of 2008: it bought up financial assets on a staggering scale, and lent additional money to banks. These actions more than doubled the size of the Fed’s assets (see Chart 2 below), and thereby increased the money supply. Sizeable stimulus measures were also implemented by European Union countries, the U.K., and Japan.

Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends_accessible.htm

These countries can afford to mount massive expansions of their spending and money supply without fearing a flight of capital and rise in interest rates precisely because they are the top of the world imperialist order. In any episode of global economic turbulence, even one that starts in the developed world, capital flies to the leading imperialist countries as safe havens to store value. This is most of all true of the US, whose currency is the leading international currency; in fact, most countries hold their foreign exchange reserves predominantly in dollars.

While these expansionary measures by the US and other imperialist powers have led to a rapid revival of growth in their economies, they have also created a sea of money seeking higher returns elsewhere. One such possible destination is the underdeveloped (or Third World) countries. However, there is a problem: many of these countries are in a debt crisis – a debt crisis which developed over the course of the previous decade.

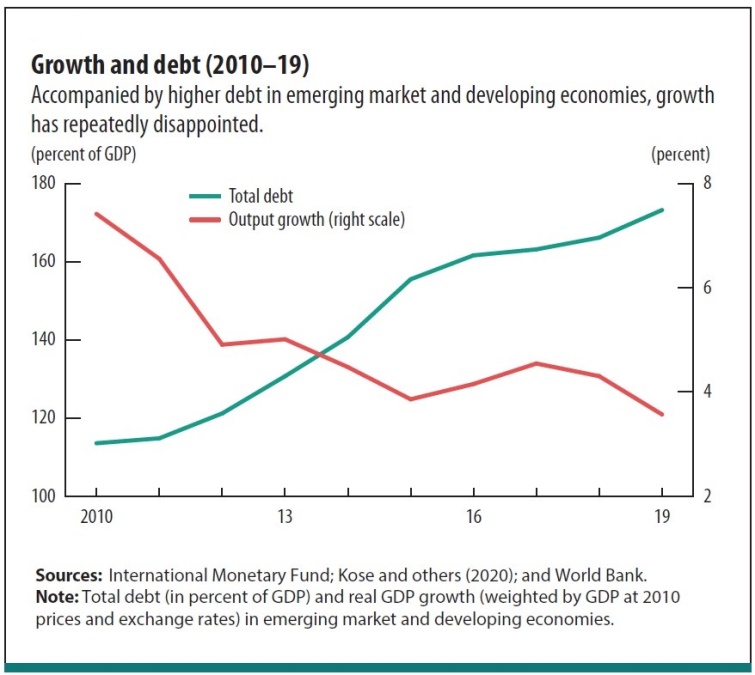

It is conventional to blame debtors for unsustainable debts. However, closer examination reveals that the debt crisis of the underdeveloped countries was the product of an earlier stimulus programme of the imperialist countries, which started in response to the Great Financial Crisis (GFC) of 2008. The US Fed’s recent response to Covid-19 was patterned on its response to the GFC during 2008-15 (see Chart 2 above). Then, too, the Fed’s and European Central Bank’s actions created a sea of money from the imperialist countries seeking higher returns in the Third World. This resulted in “the largest, fastest and most broad-based increase in debt in these [developing] economies in the past 50 years.” Even as the developing countries’ debt grew rapidly, the growth of their output slowed sharply, as can be seen from Chart 3 below.

Chart 3

Source: M. Ayhan Kose, Franziska Ohnsorge, Peter Nagle, and Naotaka Sugawara, “Caught by the Cresting Debt Wave”, Finance and Development, June 2020.

The sovereign debt (government or government-guaranteed debt) of “low- and middle-income” countries more than doubled during 2008-2018; but the share of the sovereign debt owed to private creditors rose nearly three-fold. Nearly 90 per cent of this was sovereign bonds. “During the past decade, 58 low- and middle-income countries issued sovereign bonds, most of them for the first time. Collectively, they now owe over $480 billion to private bondholders.” In the Covid-19 crisis, these countries’ government debt rose even further.

Rapid growth in the developed countries; economic ‘scarring’ and poverty in the underdeveloped countries

On the back of its giant expansion in government spending, the US economy is projected to grow at a hectic pace during 2021 and 2022. US financial firms too, awash with cheap funds, have been making extraordinary profits (the top five – J.P. Morgan, Goldman Sachs, Bank of America, Morgan Stanley, and Citigroup – raked in an additional $51 billion in trading revenues in the pandemic period).

However, there is a stark global divergence. The World Bank expects that 90 per cent of advanced economies will regain their pre-pandemic per capita income levels by 2022, but two-thirds of developing countries will not do so: “Emerging Market and Developing Economies (EMDE) output is likely to remain below its prepandemic trend for a prolonged period, as many fundamental drivers of growth have been scarred by the pandemic… The pandemic’s impact on poverty could reverberate for a prolonged period due to its scarring effects on long term growth prospects… As a result, per capita income catch-up with advanced economies could slow or even reverse in many poorer countries.”

This stark divergence in outcomes is due to the gulf between their respective levels of government spending, as reflected in Chart 4.

Chart 4

Source: Tweet of June 19, 2021 by Gita Gopinath, chief economist, IMF.

While the IMF publicly notes the long-term economic damage that is taking place in the developing countries, and makes sympathetic noises regarding the fact that they are starved of funds, in fact it has been pressurising these countries to cut their spending. Recent research by Oxfam finds that the IMF is pushing countries down the path of austerity as soon as the pandemic subsides. Similarly, a review by the European Network on Debt and Development (Eurodad) of IMF staff reports for 80 developing countries finds that though these countries implemented very meagre Covid-19 response packages (2.2 per cent of GDP in 2020), they are nevertheless starting ‘fiscal consolidation’ (tax increases and expenditure cuts – in other words, squeezing of the working people) in 2021 itself. The eventual size of the so-called ‘fiscal consolidation’ will be nearly five times the amount of resources allocated to Covid-19 packages in 2020. Much of the burden is to be shifted to the vulnerable through an increase in indirect taxes. Public services expenditure is being slashed. In a word, the review says that IMF programmes are “on track to arrest development efforts in the next decade.”

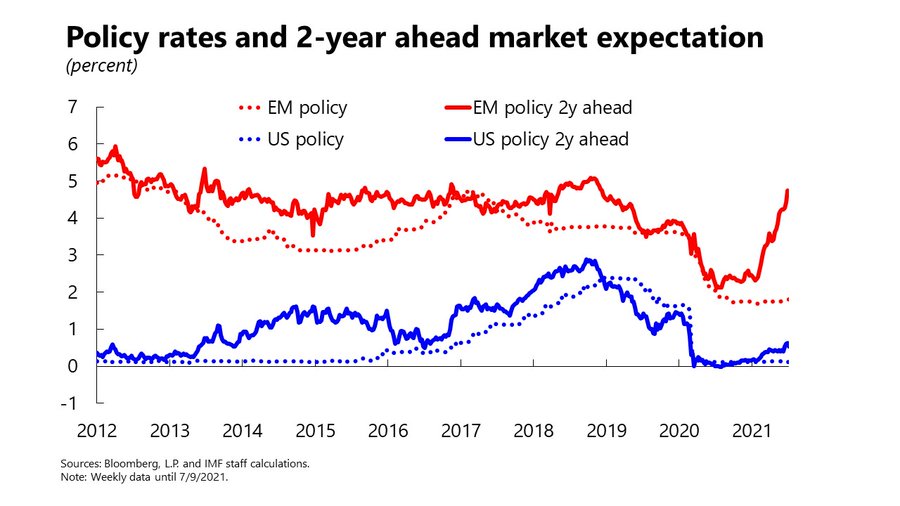

The immediate threat to debt-laden Third World countries is that global capital will exit their economies in favour of the US and other ‘safe havens’. This would send Third World currencies downhill and their interest rates soaring. In September 2021 US Fed Chair Jerome Powell signalled a rise in interest rates, and the US Fed has indicated it plans to stop its Quantitative Easing programme by mid-2022. The last time the Fed started to ‘taper’ off its asset purchases was in 2013; this move led to a sudden exit of global investors out of Third World markets, falls in their share markets and exchange rates, and a rise in their government bond yields (interest rates).

The effects of this ‘tapering’ will be divergent in the developed and underdeveloped countries. The financial markets already anticipate that interest rates in the developing countries will climb steeply in the future, but will remain low in the US (see Chart 5) – another instance of their respective diverging fates. Given the contrasting situation of the two sets of economies, a debt crisis in the developing countries may open up opportunities for the US and other developed countries to buy the developing countries’ assets cheaply.

Chart 5

Source: Same as Chart 4.