An official report prepared under the Vajpayee government in 2002 gives us a glimpse of some of the major lobbies pressing for restructuring of India’s agriculture and food economy.

What interests lie behind the three Farm Acts of the Modi government? Various private corporate interests, domestic and foreign, with stakes in: trading in grain and other agricultural commodities; contract or corporate farming; logistics (including storage and transport of agricultural products); seeds, fertiliser, and other inputs; food processing; organised retail; and financial sector activities (including investment in commodity markets).

Worldwide, many of these firms are involved in multiple activities. The leading agricultural traders own ocean-going ships, ports, railways, refineries, silos, oil mills and factories. Their activities include growing crops; selling inputs; buying output, transporting and storing it; processing crops to produce various products, or supplying other producers of final goods; and carrying on sophisticated financial speculation in agricultural commodity markets.

The financial news service Bloomberg once said that Cargill was not only part of the value chain but was the chain itself – from the field to the shop counter. In a 2001 corporate brochure Cargill described itself thus: “We are the flour in your bread, the wheat in your noodles, the salt on your fries. We are the corn in your tortillas, the chocolate in your dessert, the sweetener in your soft drink. We are the oil in your salad dressing and the beef, pork or chicken you eat for dinner. We are the cotton in your clothing, the backing on your carpet and the fertilizer in your field”.[1] Four such firms, of which Cargill is the largest, control 70 per cent of the world market in agricultural commodities.

Although the major Indian business groups Reliance and Adani have both strenuously denied pushing the so-called ‘reforms’, and the Modi government has strenuously claimed that it has no plans to wind up public procurement, both Government officials and private investors state their views and demands more frankly behind closed doors. These demands are then processed into recommendations by official committees – dressed in the language of ‘greater efficiency’ and ‘fiscal savings’.

Thus the High Level Committee on Reorienting the Role and Restructuring the Food Corporation of India (known as the Shanta Kumar Committee), set up in August 2014, received representations from various private corporate firms, including Adani Logistics, Cargill India, ITC Agribusiness Division, CII Food and Agriculture Centre of Excellence (CII FACE), Yes Bank, and so on. The report of the Shanta Kumar Committee fails to mention what they asked for, but the recommendations of the report themselves read like the wish-list of these firms.[2]

Committee for Long Term Grain Policy

However, an earlier high-level official committee report did reveal a bit more regarding the real intentions of those pressing for such ‘reforms’. Although its report is 18 years old, the present agenda of the rulers has been under preparation for even longer, and so the report of 2002 remains very relevant.

The High Level Committee for Long Term Grain Policy, headed by Abhijit Sen, was set up in 2000, and submitted its report in 2002. The Terms of Reference assigned to it required it to examine the following areas:

i) Minimum Support Prices (MSP) and price support operations

ii) the role of the Food Corporation of India (FCI)

iii) the functioning of the Public Distribution System (PDS)

iv) policies regarding buffer stocks, open market sales and foreign trade

v) allocation of grain for rural development and other welfare programmes.

(Since we are unable to locate a copy of the Committee’s Report on the internet, we are attaching a pdf of the here for those interested in reading it.)

The aims of multinational grain corporations

Keep in mind that the corporations of the advanced countries have been trying for many years to get control of the foodgrains market of India. (Thus we wrote about this question in 2004 and 2006; much of what we said then can be reproduced now without much change.[3]) These foreign corporations have been restrained by the existence of substantial domestic production in India, and by India’s long-standing system of food security (i.e., the public procurement of foodgrains and the public distribution system).

Despite the fact that that the existing food security system has been undermined over the years of liberalisation, and despite its serious inadequacy even earlier in ensuring adequate nutrition to all India’s citizens, the sheer existence of this system as such even now constitutes an obstacle to the profit-drive of the multinational agribusinesses. For, to some extent, it protects domestic production (by guaranteeing grain-growers a reasonable price) and discourages speculation and excessive profit in foodgrains trade (by maintaining substantial public stocks which can be unloaded by the Government on the market at low prices in case of a steep rise in prices).

Therefore it is imperative for giant firms of the imperialist countries to dismantle that system. This would pave the way for regular grain imports by India, and allow the grain multinationals to reap large profits in such trade. This shift toward import dependence would further orient Indian agriculture away from foodgrain, to growing such produce as is demanded by the advanced countries (as well as by the elite of India and of other developing countries).

In 2000 itself, when the Vajpayee government set up the Committee for Long Term Grain Policy (CLTGP), it was already exploring the possibility of shutting down public procurement, on the excuse of the excess food stocks. Note that these excess food stocks had arisen after the earlier United Front government had introduced the Targeted Public Distribution System (TPDS) in 1997, which divided the population into so-called “Below Poverty Line” (BPL) and “Above Poverty Line” (APL), and jacked up the prices of APL grains so steeply that this layer of consumers simply exited the PDS. The consequent piling up of foodgrains with the FCI was then adduced as evidence that public procurement and the PDS were no longer needed. The TPDS was in fact the first step in the destruction of the PDS.

Lobbying for dismantling the FCI and PDS

Rather than address this problem by reviving the PDS, a strong lobby at the time pressed for dismantling the FCI. The CLTGP stated that it “had to take note of an opinion that the existing system need not be salvaged and that the present crisis may in fact be an opportunity to do away not only with Minimum Support Prices (MSP) but also with the Public Distribution System (PDS), and restrict the role of the Food Corporation of India (FCI) to maintaining a reduced level of buffer stocks.”

Indeed this view came not only from private corporate interests, but from the Government itself. The CLTGP reported:

Subsequent to submission of its Interim Report, the terms of reference of the Committee were widened to include an examination of the possibility of providing direct income support to farmers in place of the present system of price support through physical procurement at MSP. In particular, it was asked to examine a proposal from the Ministry of Agriculture (MoA) to initiate an insurance based income support linked to Minimum Support Prices (MSP) to replace the current system of open-ended grain purchase at these prices by the Food Corporation of India (FCI). (emphasis added)

However, given the enormous consequences of such a step, the proposal faced widespread opposition from state governments, which would have had to face mass unrest:

With the exception of a few economists, the almost unanimous opinion was that price stabilisation was an important objective and that for this the present MSP system with open-ended procurement should continue. In particular, every State government that the Committee has consulted rejected any idea of doing away with the present MSP system….

The “few economists” (the phrase perhaps refers to an economist member of the CLTGP, who was later the moving spirit behind the Shanta Kumar Committee) who plugged this dismantling proposal argued that “MSP policy is a relic from the closed economy, that any intervention by government in physical trade and price formation is potentially distorting, that markets should be allowed to function freely without government intervention, and that if this does lead to price and income instability, the solution is to compensate for income loss through direct income transfers.”

The threat to food production itself

However, the CLTGP demolished this argument. It observed that such a policy might threaten agricultural production itself, and thereby the food security of the country:

Price instability is not merely a matter of concern from the point of view of the welfare of producers and consumers and their incomes. There is very strong evidence from across the world and from India’s own experience in the past that agricultural investment and growth is adversely affected if price instability is high and, in particular, if farmers cannot be reasonably sure that prices will remain above their costs of production.

Most countries adopt policies to stabilise farm prices, and the comparative performance of India has till recently been good. The coefficient of variation of rice and wheat prices in India has been contained to 4 to 7 per cent during the last twenty years as against 15 to 25 per cent observed in world prices [i.e., prices were much more volatile internationally than in India]….

The Committee, therefore, reiterates its view that price stabilisation should be a principal goal of long-term grain policy, and is of the opinion that it would be premature to move towards any general scheme for farm income support to replace current MSP policy.

What would be the consequences of stopping procurement? The CLTGP’s report observes that, first, with State agencies out of the market, the price paid to peasants even in the main area of procurement, namely, Punjab, Haryana and western U.P., would plummet. The Committee estimated that “without price support, farm level prices are unlikely to exceed Rs 350 per quintal for either paddy or wheat, much less than what almost all farmers actually received last year and also less than full production cost (including imputed costs for family labour, land and capital) in most states.” It estimated that, in the event of such a “sudden annulment”, “the immediate loss to wheat and rice farmers would be over Rs 40,000 crore (Rs 400 billion) if evaluated notionally as shortfall of likely farm prices from current MSP on entire production”. (In 2019-20 rupee terms, this sum would be a loss of nearly Rs 129,000 crore.[4])

The fate of these farmers can be imagined from the fact that, as the Report notes, “producer prices are now below the cost of production in many parts of Eastern India where price support operations are not effective”. Thus if prices were similarly depressed in the main grain surplus states, output would fall.

Output fall would lead to import dependence, hitting both producers and consumers

If India’s cereals output falls, even as its requirements continue to rise, it would have to import cereals. At the time (in 2002), the CLTGP pointed out: “The FAO projects developing country cereals imports increasing from 107 million tonnes in 1995-97 to 198 and 270 million tonnes in 2015 and 2030, with very large shortages in Near East/North Africa and East Asia. In this scenario, North America and Europe will monopolise supplies in world trade and may cut the huge farm subsidies that they give currently. World cereals prices would then average at least at mid-1990s levels, i.e. twice present levels.” (ibid) That is, the advanced countries’ dominance in world grain trade would enable them to fix prices high enough such that they would no longer need to subsidise their domestic production.

The CLTGP pointed out that, since India accounted for 15 per cent of world consumption of cereals, and it had a growing population, it was essential to maintain sufficient buffer stocks of its own. India’s buffer stocks at the time were equivalent to 15-25 per cent of world stocks, and 40 per cent of world trade in rice and wheat. Any large reduction in India’s buffer stocks “will almost certainly affect world prices”, the Committee warned, pointing out that both farmers and consumers would successively be hit. First farmers would be hit by depressed prices; later, once India became dependent on imports, prices could rise on the international market, and Indian consumers would be hit:

Thus, although the immediate impact of “sudden annulment” would be the large adverse effect on farmers noted above, this could be followed by a price spike. If stocks are unduly reduced, and the PDS system is wound up, there would be no protection for consumers from the resulting hurt. This would of course be severe if stock depletion is followed by both a short domestic harvest and a world price spike, as has happened in the past, but could be significant even if harvests are normal but exports are allowed freely through a spike.

Multinational grain firms: “We won’t invest unless buffer stocks are eliminated”

The Committee gives a revealing and candid glimpse of the calculations of private firms. When asked whether they would invest in grain trade in India,

representatives of multinational grain companies have told the Committee that large investments are unlikely, even with ECA [Essential Commodities Act] restrictions on movement and storage removed, unless there is long-term consistency and predictability in government policies and the potential threat posed by high stock levels is removed. (emphasis added)

To whom are the grain stocks of the FCI a “threat”? Certainly not to the Indian people, for whom they represent an insurance against grain shortages and private profiteering. The FCI’s stocks are a threat to profiteering by the private sector. That is, if grain prices rise sharply, the people will apply pressure on the Government to control prices, by distributing the grain stocks through the Public Distribution System, or even by open market sales. The multinational grain companies would then not be able to reap the super-profits they are looking for. Hence they not only want an assurance of permanent Government policies in favour of the private sector, but the effective dismantling of the Government’s buffer stocks of grain.

Disregarding the views of the multinational grain companies and their supporters in the Government and in the Committee itself, the CLTGP categorically concluded: “The Committee is therefore opposed to any dismantling of FCI, and considers premature suggestions that it be ‘unbundled’ by splitting it either regionally or by operation.”

Thus the present rulers are fully aware of the consequences of the steps they are taking. In 2014, quite consciously, they set up the High Level Committee for Reorienting the Role and Restructuring of the Food Corporation of India (the Shanta Kumar Committee) to take an exactly reverse course.

The Report of the Shanta Kumar Committee of 2014 did not even make a single reference to the CLTGP report. The Shanta Kumar Committee simply revived the very views which the CLTGP had refuted, without in turn attempting to rebut the CLTGP’s counter-arguments.

Predictions largely borne out

The CLTGP’s predictions in certain respects have been borne out by the trends in international trade and international prices.

(1) As anticipated, developing country net cereals imports (i.e., cereals imports minus cereals exports) did rise substantially after 2002, to 179 million tonnes in 2015 (and further to 187 million tonnes by 2019). (See Chart 1) In the last decade, imports as a share of total calorie availability rose in the Asia Pacific, sub-Saharan Africa and the Near East and North Africa.[5]

Data from the database of OECD-FAO Agricultural Outlook.

(2) As anticipated, grain prices rose sharply over the lows of 2000. The international price of wheat rose steeply, finally settling at $215 in 2015 – higher than the price of the mid-1990s. Similarly, rice prices nearly doubled to $395, and maize prices nearly doubled to $164 in 2015.[6]

Source: OECD-FAO Agricultural Outlook database

As can be seen from these steep price movements, it makes little sense to base India’s food security on imports.

In the first place, the international market in agricultural products is far removed from the idealised ‘free market’. Prices on the international market are highly distorted by subsidies in the advanced countries. While the advanced countries apply enormous pressure on India to scrap its meagre agricultural subsidies, the advanced countries’ own subsidies are vast multiples of India’s. According to the OECD, India’s budgetary spending to support agricultural producers was equivalent to 7.8 per cent of gross farm receipts in India. However, the total support to agriculture provided in the OECD countries (i.e., the rich countries) accounted for 17.6 per cent of gross farm receipts in those countries. The absolute sums involved are staggeringly large: OECD agricultural producer support averaged $319 billion a year during 2017-19, of which72 per cent ($231 billion) was given to producers individually. Keep in mind that employment in agriculture is less than 5 per cent of total employment in the OECD countries, where is it is nearly half of employment in India.

Secondly, any decision made on the basis of present prices might be invalidated by a major shift in price levels. But by that time the damage may have been long-term: India might become dependent on imports, and the structure of its agricultural production might shift to crops which are not for domestic consumption.

India’s consumption needs are very large in relation to world trade in many commodities. For example, India’s wheat consumption is about half of world trade in wheat, and its rice consumption is more than twice world trade in rice. Hence any major shift to the international market will have a large impact on international prices.

Financialising the food requirements of a nation

Although the CLTGP report clearly warned against the proposed winding down of the FCI, the UPA government (which came to power in 2004) began traveling down the same path as the earlier Vajpayee government, by virtually freezing the MSP for several years and deliberately bringing down the procurement of wheat. This created an alibi for making large imports in 2006 and to a lesser extent in 2007. However, perhaps fearing the political consequences, the UPA government retreated from this policy, and imports once again fell. More recently, in 2016-17, too, India made large imports of wheat. However, imports remain sporadic, and there is no clear trend towards increasing imports, as can be seen from the chart below.

Source: Agricultural Statistics at a Glance 2019, Ministry of Agriculture and Farmers’ Welfare

The obstacle to increasing imports is the continuing sizeable production of wheat in India, which in turn is sustained by the system of public procurement. Hence what multinational grain traders, and the international agencies and economists that represent their interests, press for is the financialisation of food security. That is, instead of holding physical buffer stocks, the country would hold foreign exchange reserves (even if these reserves are made up of volatile foreign investments, which can fly out at a moment’s notice). Instead of guaranteeing peasants a price which covers their costs of production and sustenance, the rulers would promise them cash transfers to make up the gap between the market price and the desired price. Instead of guaranteeing consumers a certain minimum quantity of grains at low prices, the rulers would promise them cash transfers to ensure they can buy grains at the market price.

The erstwhile Chief Economic Advisor, Arvind Subramanian, declared in the Economic Survey 2014-15 that, with the near-universalisation of Jan Dhan bank accounts, Aadhar numbers, and mobile phones (“J-A-M”), the Government could now do away with subsidies:

If the JAM Number Trinity can be seamlessly linked, and all subsidies rolled into one or a few monthly transfers, real progress in terms of direct income support to the poor may finally be possible. The heady prospect for the Indian economy is that, with strong investments in state capacity, Nirvana today seems within reach. It will be a Nirvana for two reasons: the poor will be protected and provided for; and many prices in India will be liberated to perform their role of efficiently allocating resources in the economy and boosting long run growth.

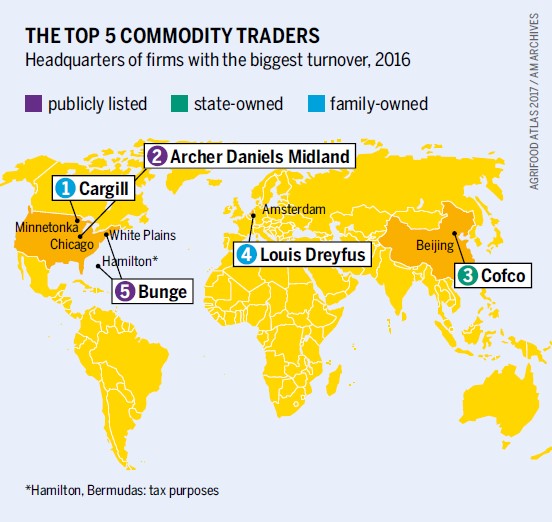

Indeed this is precisely the Nirvana the giant multinational grain traders known as “ABCD” (Archer Daniel Midlands, Bunge, Cargill, and Louis Dreyfus) would like to achieve. They possess large and growing financial divisions specialising in speculating on agricultural commodities:

The trade in all commodities is characterized by a high level of risk. Any number of factors –natural disasters, crop failures, political or economic shifts – can affect the prices of commodities, which may be locked into a long supply chain. While prices can change quickly, commodity traders are dealing with a physical stock that is bulky, expensive to store, and harvested only at certain periods of the year. Prices are as much about anticipated supply and demand as they are about existing conditions. The level of risk and volatility in the trading of standardized and generic products pushes the companies to look for strategies that will increase their stability and predictability. The finance and risk management divisions of the ABCD traders are huge and absolutely central to their businesses. The companies trade in futures markets on their own account and on behalf of others.[7]

Source: Agrifood Atlas, Heinrich Boll Foundation

Using their inside knowledge and research, these firms can reap profits whether international prices go down or up:

Extreme price fluctuations in global agricultural markets do not threaten Cargill. On the contrary, the firm benefits from them. Early on, the company’s experts recognized the huge harvest shortfall of 2012. They speculated on increased prices for soybeans, wheat and corn, and made favourable future purchase contracts that could be traded on the stock exchange. When prices rose, they sold these contracts, making a considerable profit. In 2016, Cargill and its three major competitors made less money as a result of low world prices and fluctuations.[8]

The precursor: the destruction of India’s indigenous edible oil sector

How rapidly such a shift can take place can be seen in the case of edible oils. By 1991, India had achieved near self-sufficiency in edible oils, through an increase in both area and yields. However, with India’s joining the World Trade Organisation, it put imports of edible oils and oilseeds on Open General License, and steadily reduced import tariffs. Government efforts at promotion of domestic oilseeds were quietly folded up. Systematic economic sabotage of India’s indigenous oils too played a role, as an article by two veterans of the edible oil industry brings out starkly. The result was a rapid decline in India’s oilseeds production and its oil extraction and refining industry. Peasants in Gujarat growing peanuts and other oilseeds shifted to other crops.

Among the major beneficiaries were the same ‘ABCD’ firms that control the world’s grain trade. These firms were present in Indonesia and Malaysia, the main producers of palm oil, which is far cheaper than other edible oils; they were also active in soyabean trading. These firms now exported to India, and set up operations in India as well. Among India’s major edible oil firms is Adani Wilmar, a joint venture between the ubiquitous Adani and the Singapore firm Wilmar, in which the US giant Archer Daniel Midlands has a 25 per cent stake. Other ABCD firms in India’s edible oil sector include Bunge and Cargill.

Today a staggering 70 per cent of India’s edible oil consumption is imported. In the decade 2010-2020, India spent nearly $97 billion on importing edible oils. In the present period, during which the Government claims to be promoting ‘Atmanirbharta’ (self-reliance), the Government has reduced the import duty on crude palm oil by 10 percentage points (from 37.5 per cent to 27.5 per cent) on November 27, 2020.

Source: Agricultural Statistics at a Glance, Ministry of Agriculture and Farmers’ Welfare

Source: Reserve Bank of India Database on the Indian Economy

Conclusion

In brief, the financialisation of India’s food security would both devastate India’s peasantry (India’s single largest sector of employment) as well as leave the sustenance of 1.4 billion people at the mercy of international speculators. Vast buffer stocks would still exist; but instead of India holding these stocks, they would be held by multinational trading firms, and India would bid for them with borrowed funds. Thus the financialisation of food security also represents the surrender of food sovereignty.

- Agrifood Atlas, Heinrich Boll Foundation, 2017, p. 26. ↑

- The Shanta Kumar Committee called for the winding down of the FCI, the system of public procurement, and the public distribution system (PDS), and for these to be replaced by cash transfers to farmers and consumers. It also called for the involvement of the private sector in every stage of the food supply chain. ↑

- We said in 2006: “the wheat imports are part of a broader policy which will further degrade India’s ‘food security’ and serve the interests of foreign and domestic big capital: (1) India’s production of foodgrains is being allowed to stagnate. That is, production per head is falling. This will create a large market here for imports of foodgrains (particularly wheat) from multinational corporations of the US, Europe and Australia. (2) Step by step the Food Corporation of India is being dismantled; the system of minimum support prices (MSPs) is being surreptitiously scrapped; the warehousing system is being privatised; and multinational grain firms are being allowed a free hand to purchase directly from peasants (in the absence of any state intervention). These corporations, besides, will be allowed massive speculation in foodgrains, at the expense of Indian consumers. (3) More land is being diverted to horticultural crops for export or for the urban elite. With the entry of giant multinational retail firms like Wal-Mart and Indian corporations like Reliance, such crops will be produced increasingly by contract farming. In this larger process, millions of Indian peasants – already in the throes of a profound agrarian crisis – would be displaced by imports, bankrupted and dispossessed of their land. At the same time the food security of the vast majority of people would be made the plaything of speculators and multinational corporations.” https://rupe-india.org/42/wheat.html At the time, however, the rulers postponed the full implementation of these changes when they felt that they could not manage the political consequences. ↑

- Using the Consumer Price Index for Agricultural Labour. ↑

- During the period 2007-09 to 2017-19, imports as a share of total calorie availability rose in the Asia Pacific, from 16.9 per cent to 20.8 per cent; in sub-Saharan Africa, from 16.9 per cent to 19.5 per cent; and in the Near East and North Africa, from 50.8 per cent to 53.7 per cent. Source: database of OECD-FAO Agricultural Outlook. ↑

- Data from the database of OECD-FAO Agricultural Outlook. ↑

- Sophia Murphy, David Burch, Jennifer Clapp, Cereal Secrets: The World’s Largest Grain Traders and Global Agriculture, Oxfam, 2014, p. 13. ↑

- Agrifood Atlas, p. 26. ↑